What Is Enaria?

Dec 16, 2025

2 mins read

What Is Enaria?

A New Standard for AI-Driven Trading Intelligence

In today’s financial markets, speed, discipline, and consistency matter more than ever. Yet most traders, both retail and professional, still rely on fragmented tools, manual analysis, and emotional decision-making.

Enaria was built to change that.

Enaria in One Sentence

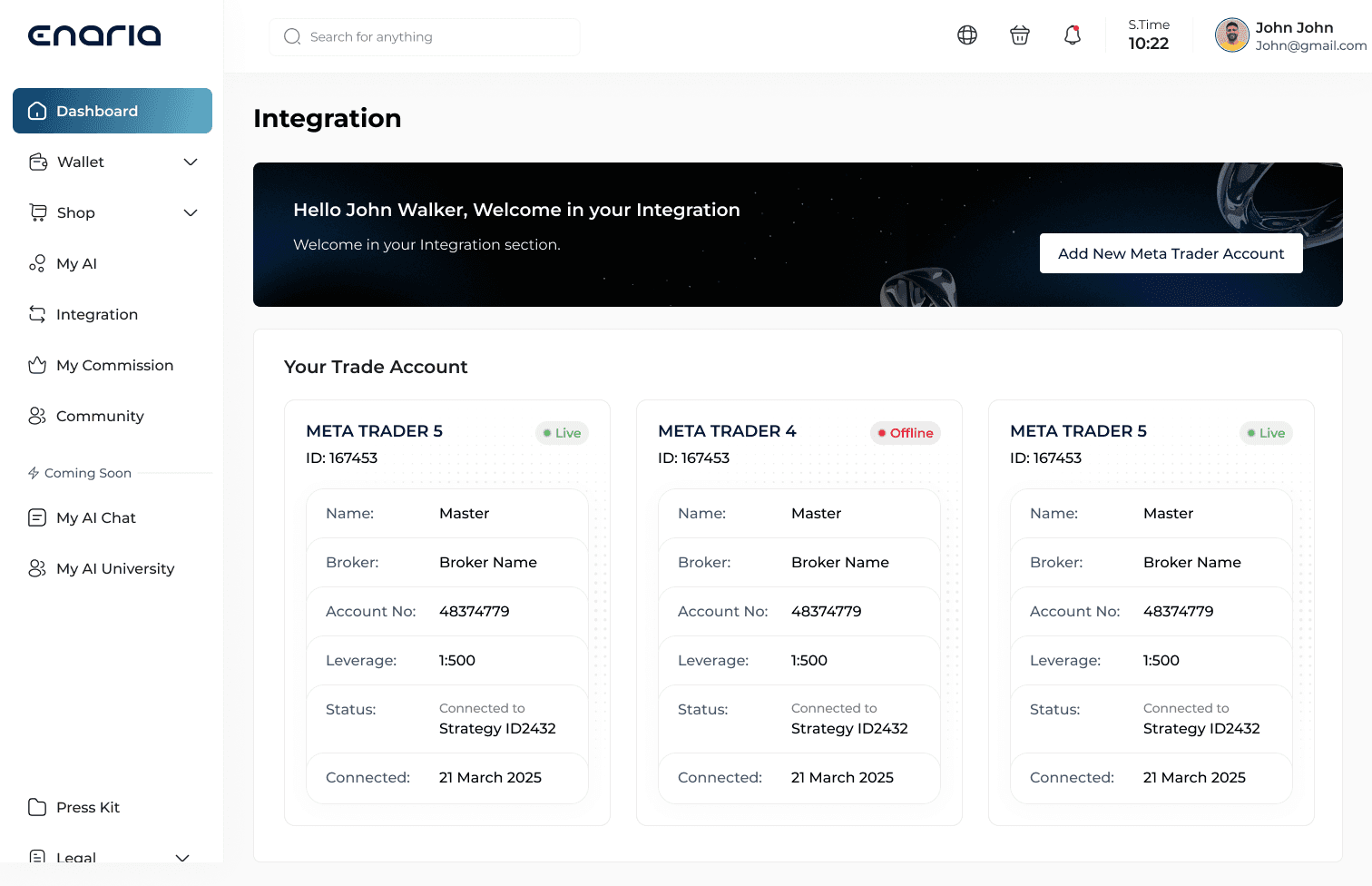

Enaria is an AI-powered decision intelligence platform designed to help traders structure, analyze, and manage market decisions with greater clarity and control.

It does not replace the trader.

It enhances the way decisions are made.

The Problem Enaria Solves

Trading is not just about entries and exits. It’s about:

Interpreting complex market data in real time

Managing risk consistently

Reducing emotional and repetitive decision fatigue

Maintaining discipline during volatile conditions

Most traders lose not because of lack of opportunity—but because of lack of structure.

How Enaria Works

Enaria combines advanced AI models, structured logic, and real-time monitoring to support traders throughout their decision process.

The platform helps users:

Analyze market conditions using AI-driven logic

Monitor predefined risk and exposure parameters

Structure decision-making rules consistently

Reduce manual friction during trade management

Enaria integrates with external trading platforms via secure APIs, acting as an intelligence and execution support layer, not a broker or a fund.

Who Enaria Is For

Enaria is designed for:

Active retail traders seeking more discipline

Professional traders and analysts

Trading teams and communities

Educators and signal providers looking for structure

Whether you trade daily or manage strategies at scale, Enaria adapts to your workflow.

A Philosophy of Control and Transparency

At its core, Enaria believes that:

The trader remains in control

AI supports decisions, it doesn’t replace responsibility

Risk management is not optional, it’s foundational

Enaria is not about hype.

It’s about building a smarter, more structured way to interact with the markets.